From GI Roundtable 36: Does It Pay to Borrow? (1945)

When a man has gone into debt for something that cost him a lot of money—say a house—he will usually make every effort to keep up his payments, and thus retain possession of it, even though his income may have dropped sharply. That means he may have to skimp on such things as food or clothing or the education of his children.

Have you ever known anyone who was “land poor” or “automobile poor” or “radio poor” because he had pledged so much of his income to keep up the payments on one of those things that he didn’t have enough ready cash to look after his family properly? Plenty of men have made that mistake.

A hard way of saving

“I’m going to get me a new automobile just as soon as I get out of uniform and get enough dough together for the first down payment,” says Pfc. Happy-Go-Lucky. “I figure I deserve a little fun.”

“You dope, you’ll get more headaches than fun,” says Sgt. Thrifty. About all you’ll ever use that car for is running away from bill collectors. Why don’t you get wise to yourself and save your dough instead of blowing it all in?”

“I figure I will be saving it if I put it into a car,” says Pfc. Happy-Go-Lucky. “That’s better than blowing–it on dames or liquor, isn’t it? You got an automobile, you got something to show for your dough. And besides, the girls like ’em.”

“You’ll be way ahead of the game if you save the price of the car first,” says Sgt. Thrifty. “Stick fifteen bucks in the savings bank every week for a year. That way you’ll get paid interest, instead of having to pay it yourself. And when you’ve got the dough ready you can shop around and get a really good buy-and not have to worry about the sheriff catching up with you, either.”

“Buddy, you don’t know me,” says Pfc. Happy-Go-Lucky. “That way I never would get a car—or save any money either. I know my own weaknesses. If I have to keep up the payments on a car or lose it, I’ll keep them up. But I just couldn’t sit around home for a year and watch my bank account grow. First thing you know I’d be off on a toot and that would be the end of bank account and car both.”

Do you know anyone like Pfc. Happy-Go-Lucky, who recognizes his own weakness and deliberately incurs debt in order to force himself to save? There are plenty of men like that. Many a radio, a refrigerator, even a home has been bought with money that would otherwise have been dropped in a poker game or a slot machine, because some man compelled himself to keep up the payments on something he wanted.

Thus, for one who lacks the will power to save in advance, going into debt may pay. But it is a hard, an expensive way of saving.

How does debt affect character?

It takes all kinds of people to make a world, and there are plenty who can’t look upon being in debt as cheerfully as Pfc. Happy-Go-Lucky. “The borrower is servant to the lender,” says the Bible (Proverbs XXII: 7). Most men do not like being beholden to anyone. They agree with the Spanish author of the saying, “A pig bought on credit is forever grunting.”

Have you ever noticed how being chronically in debt affects a man’s character? In many cases it saps the will to save and weakens his self-respect and his integrity. History shows beyond argument that chronic debt also impoverishes the debtor, as more and more of his income is eaten up to pay service charges and interest on his accumulated debts.

Can the government do anything?

For hundreds of years governments have tried to prevent this evil, or at least limit it, by laws against usury. Back in the Middle Ages usury was the name for any interest at all, no matter how low the rate. It was considered wicked then to charge interest on a loan. But that idea was gradually discarded. Now the usury laws only forbid the ‘charging of extortionate rates of interest.

Did you ever know anyone unlucky enough to fall into the hands of a loan shark? And did the laws against usury help him? All through history endless ways of evading these laws have been devised by ingenious and unscrupulous lenders.

The principal protection for a debtor nowadays is not the laws against usury, but the competition of lenders for his business. And so let’s take a look at the principal kinds of consumer credit.

Related Resources

September 7, 2024

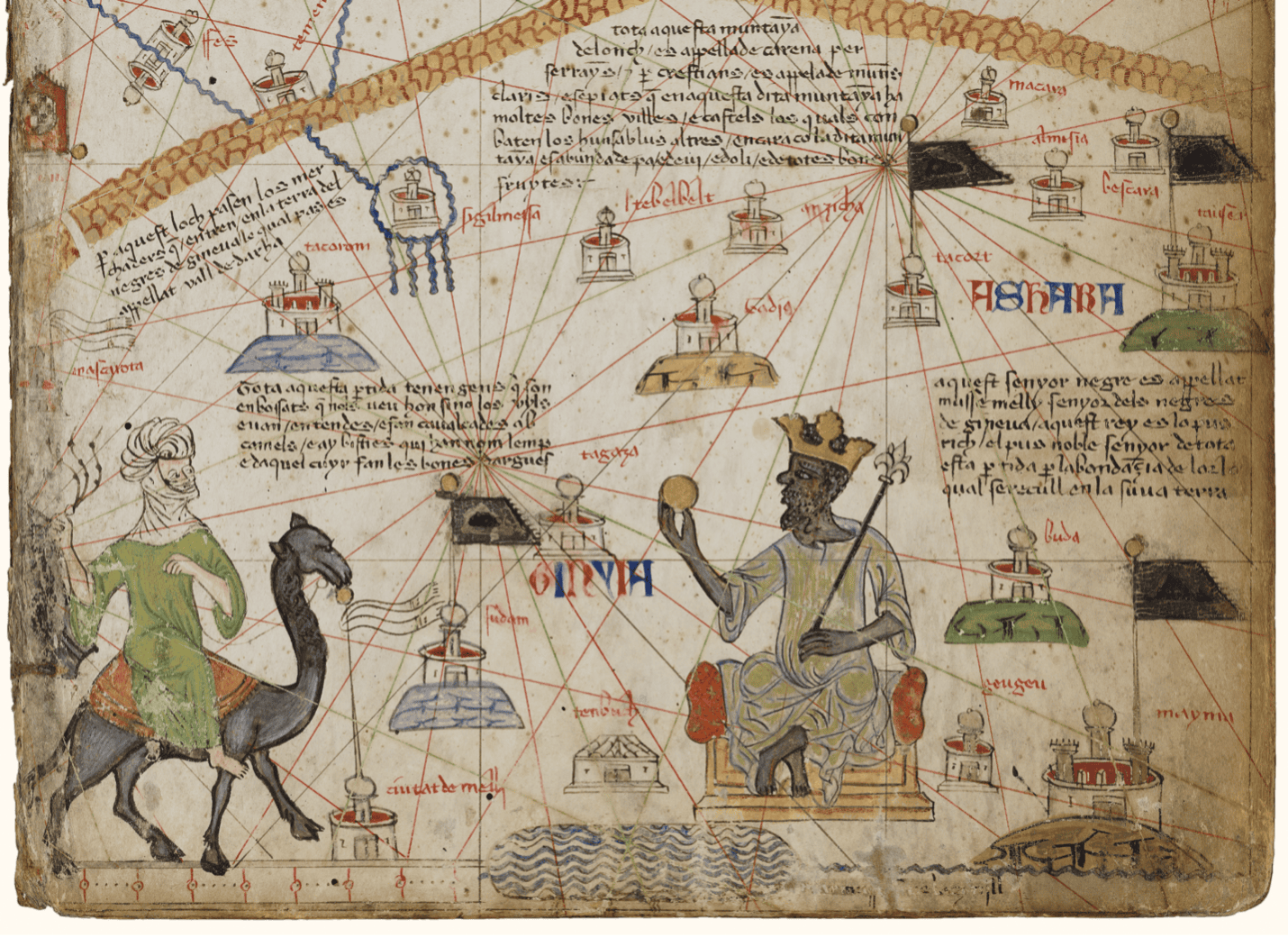

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024